On July 30th, Thailand’s National Electric Vehicle Policy Committee (NEV) approved revisions to the GST Department’s system for distributing subsidies under its “EV3.0″ and “EV3.5″ electric vehicle promotion incentive programs. Key changes include allowing locally manufactured electric vehicles for export to count toward the manufacturer’s domestic production quota (each battery electric vehicle exported will count towards a manufacturer’s local production quota by 1.5 units), encouraging automakers to establish Thailand as a regional export base. Furthermore, the Thailand Board of Investment stated that the revised terms will make it easier for companies to meet production commitments, projecting that electric vehicle exports will increase to approximately 12,500 units in 2025 and approximately 52,000 units in 2026.

On July 30th, Thailand’s National Electric Vehicle Policy Committee (NEV) approved revisions to the GST Department’s system for distributing subsidies under its “EV3.0″ and “EV3.5″ electric vehicle promotion incentive programs. Key changes include allowing locally manufactured electric vehicles for export to count toward the manufacturer’s domestic production quota (each battery electric vehicle exported will count towards a manufacturer’s local production quota by 1.5 units), encouraging automakers to establish Thailand as a regional export base. Furthermore, the Thailand Board of Investment stated that the revised terms will make it easier for companies to meet production commitments, projecting that electric vehicle exports will increase to approximately 12,500 units in 2025 and approximately 52,000 units in 2026.Tightened regulations: Companies that haven’t received extensions must submit monthly production plans; subsidies will only be disbursed after cumulative compensation reaches 50% of the promised total. Companies applying for extensions must submit a compensation plan and a bank guarantee (40 million baht for registered capital < 5 billion baht; 20 million baht for registered capital ≥ 5 billion baht).

2. Impact of Thailand’s electric vehicle policy changes on Chinese electric vehicle manufacturers: Specific impacts in the positive dimension:

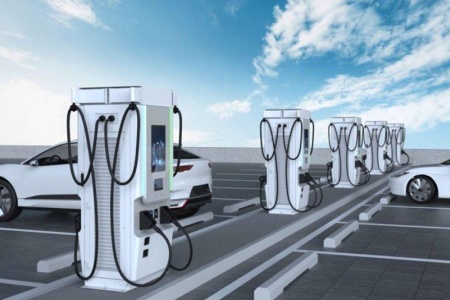

Compliance pressure eases dramatically: Export vehicles can now count toward local production quotas for the first time (1 exported vehicle = 1.5 locally produced vehicles), directly alleviating the “compensation gap” pressure faced by BYD, Great Wall, SAIC, and others due to sluggish Thai sales. Cash Flow Improvement: The requirement to “register locally before receiving subsidies” is no longer mandatory. Exports can now offset this obligation, preventing cash flow strain caused by advance funding for factory construction. Enhanced Capacity Utilization: Thailand’s factories have an annual production capacity exceeding 380,000 vehicles, yet local registrations in the first half of 2025 fell below 60,000 units. With export channels now open, priority can be given to re-exporting to Vietnam, the Philippines, or even the EU, reducing idle capacity. Strengthened Export Hub Status: Authorities project EV exports of 12,500 units in 2025 and 52,000 units in 2026, formally establishing Thailand as a “right-hand drive export base” for Chinese automakers targeting ASEAN and the EU.

Risk Dimensions Manifested: Escalating Price Wars Backfire: The International Energy Agency’s Global Electric Vehicle Outlook 2025 indicates that Chinese products now dominate 75% of Thailand’s EV market. Locally produced models with high market share build excessive inventory by eliminating delivery issues, which in turn triggers sustained price reductions. Frequent price cuts have dissatisfied existing Thai owners, while non-localized models face delivery delays. This combination erodes consumer trust in Chinese brands, prompting some users to switch to Japanese hybrids or adopt a wait-and-see approach. Concurrently, banks tightening auto loans further dampens sales.

Post time: Sep-13-2025

Portable EV Charger

Portable EV Charger Home EV Wallbox

Home EV Wallbox DC Charger Station

DC Charger Station EV Charging Module

EV Charging Module DC Charging Connector

DC Charging Connector EV Accessories

EV Accessories